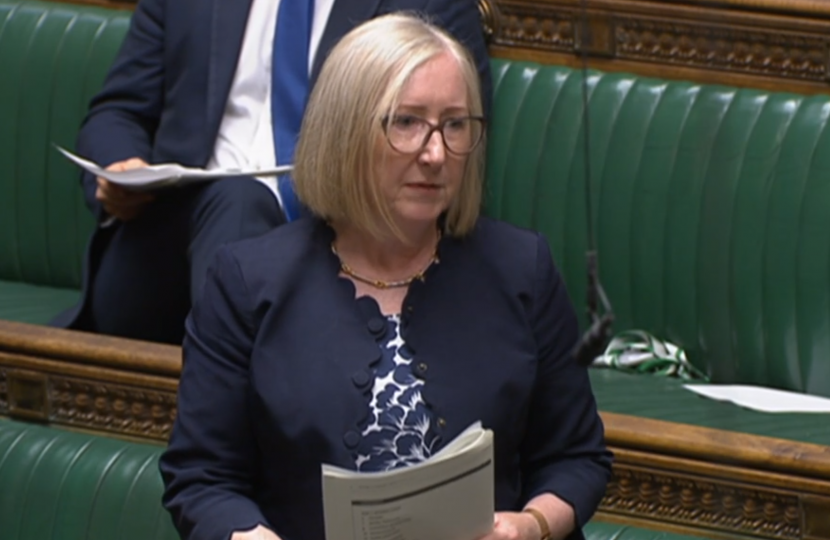

On Wednesday afternoon, I participated in a Committee of the Whole House debate on the Finance Bill 2024.

A Committee of the Whole House is sometimes used instead of a Public Bill Committee for some of a Bill’s Committee Stage in the House of Commons. Proceedings take place in the House of Commons chamber allowing all MPs to take part in the debate and to vote on the Bill’s contents.

During the debate I spoke in favour of a number of measures in the Bill, such as Clause 1, which makes full expensing permanent.

Full expensing allows companies to claim the full cost of their expenditure on plant or machinery against tax when this business investment is made. This was originally introduced as a temporary measure by the Chancellor of the Exchequer, Rt Hon Jeremy Hunt, at the Spring Budget 2023.

Businesses across the country, including Erewash based Dales Fabrications Ltd and Millitec have already benefited from this scheme, as well as the predecessor scheme of super-deduction. Thanks to the success of temporary full expensing, the Chancellor announced at the Autumn Statement that it would become permanent. By supporting permanent full expensing, we are backing business and helping grow our economy.

In my speech I also expressed my support for Clause 2 and Schedule 1 of the Bill, which simplifies the Research and Development (R&D) tax system.

By merging the Small or Medium Enterprise and R&D Expenditure Credit Scheme, the Government is simplifying the R&D tax system, reducing bureaucracy, and ensuring that taxpayers’ money is spent as effectively as possible.

I have no doubt that the measures announced in the Finance Bill will be the ignition that accelerates the UK economy and leads us to a brighter future.

You can view my full speech by following this link.